I know that white privilege is a difficult thing to wrap one’s mind around. It’s something that you never asked for and don’t realize you have unless you make a concerted effort to look at how things are for people who don’t have it. I did. I tried very hard to learn what privilege means, and the degree to which it exists. I’m still not sure I have it all figured out.

I’m going to try and present a number of seemingly unrelated data points to try and paint a picture of what privilege is and how it works. I’m going to start with income and wealth inequality. Pew recently published a paper on income inequality and how it’s been growing among racial groups since the end of the great recession. We know that the inequality gap is growing wildly between the top 1% and everybody else, but minorities are getting fewer of the crumbs left over than white people are. The wealth gap between whites has widened to a 13x multiplier. So the median worth of a white family in the US is thirteen times that of the medial wealth of a black family. In 2010, that gap between blacks and whites was 10x. The gap between whites and Hispanics smaller, but it’s still a shocking ten times multiplier up from 9x in 2010. The interesting part is that the typical (not median) worth for whites remained virtually unchanged in 2013 from the 2010 number of $82,300 (adjusted). Meanwhile, the median wealth of black households fell 33.7%, from $16,600 in 2010 to $11,000 in 2013. Among Hispanics, median wealth went down by 14.3%, from $16,000 to $13,700. Every race took a hit because of the recession so median net worth is down across the board. Pew speculates on some of the factors that may have contributed to the growing gap. Blacks and hispanics may have had to dip into more of their savings during the recession, or weren’t able to replenish their savings as much when it ended. Also, financial assets like stocks recovered more robustly than did the housing market, and since white people own more stocks (directly or through pensions or 401ks) they would have recovered more quickly.

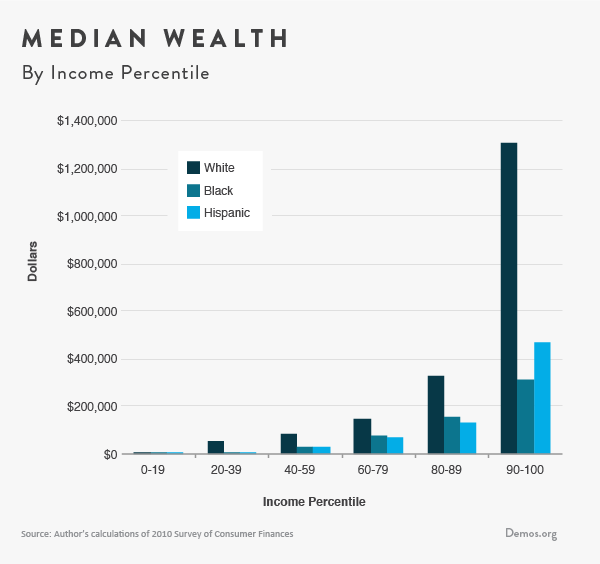

This disparity in wealth exists in every conceivable way you look at the data. Pew looked at all blacks and did a median wealth comparison to all whites. Here’s a graph that DEMOS put together, comparing blacks, Hispanics, and whites by income level.

This doesn’t really paint much rosier a picture, does it? For the bigots who don’t know they’re bigots, and are in fact positive they’re not bigots, but are totally bigots, let me answer your point for you. No, it’s not their fault for not picking themselves up by the bootstraps and getting themselves an education. Wanna know how you can tell? That median income for the top 10% of earners is just under 500k. Are you telling me that those people didn’t beat your ass over the head with their bootstraps by making over 3x your median income? And still, with all that bootstrapping, they can’t manage to earn more than 1/3 of their white counterparts? They’re clearly educated. So what happened? That’s easy: that top 10% of whites inherited their bootstraps and they were sewn together for them using gold thread. Remember, 3 generations ago, black people had virtually no access to higher education. From the DEMOS article;

"Why is this the case? There are many factors, but one in particular looms large. It turns out that three centuries of enslavement followed by another bonus century of explicit racial apartheid was hell on black wealth accumulation. Wealth accumulation opportunities haven’t exactly been evenly distributed in the last half century either. Because wealth is the sort of thing you transmit across generations and down family lines (e.g. through inheritance, gifts, and so on), racial wealth disparities remain quite massive."

I cannot believe this needs to be explained to some, but it does.

I found a really interesting study done by the Institute On Assets and Social Policy, who really took a close look into why the disparity among blacks and whites exists. From the study;

"Our analysis found little evidence to support common perceptions about what underlies the ability to build wealth, including the notion that personal attributes and behavioral choices are key pieces of the equation. Instead, the evidence points to policy and the configuration of both opportunities and barriers in workplaces, schools, and communities that reinforce deeply entrenched racial dynamics in how wealth is accumulated and that continue to permeate the most important spheres of everyday life."

They’re talking about the institutional racism that privilege is part of. They found an increase of $152,000 in the disparity of median worth between 1984 and 2009. Here’s an excerpt from the study, explaining their approach to getting to the bottom of the widening wealth gap;

"We started our analysis with an overriding question: Why has economic inequality become so entrenched in our post-Civil Rights era of supposed legal equality? The first step was to identify the critical aspects of contemporary society that are driving this inequality Next, we sought to determine whether equal accomplishments are producing equal wealth gains for whites and African-Americans This approach allows for an evidence based examination of whether the growing racial wealth gap is primarily the result of individual choices and cultural characteristics or policies and institutional practices that create different opportunities for increasing wealth in white and black families."

They looked at the households whose wealth increased over that 25 year period and found that years of home ownership accounts for 27% of that disparity. The second largest factor is family income. More education = more income, but it = 5% more income for whites than it does for blacks. Inheritance accounts for 5% of the gap. The amount of wealth that a family started with at the beginning of that 25 year period determined how much wealth they would have by the end. Unemployment was the only significant factor that depleted wealth. That accounts for 9% of the gap. From the study;

"In addition to continuing discrimination, labor market instability affects African-Americans more negatively than whites."

Those factors that I just went through explain 66% of the wealth gap. So they dove deeper into those factors to study how these effects differed by race. I’m going to lift paragraphs directly from the article because I can’t improve upon the explanation;

"The number of years families owned their homes was the largest predictor of the gap in wealth growth by race. Residential segregation by government design has a long legacy in this country and underpins many of the challenges African-American families face in buying homes and increasing equity. There are several reasons why home equity rises so much more for whites than African-Americans:

Because residential segregation artificially lowers demand, placing a forced ceiling on home equity for African-Americans who own homes in non-white neighborhoods

Because whites are far more able to give inheritances or family assistance for down payments due to historical wealth accumulation, white families buy homes and start acquiring equity an average eight years earlier than black families

Because whites are far more able to give family financial assistance, larger up-front payments by white homeowners lower interest rates and lending costs; and

Due to historic differences in access to credit, typically lower incomes, and factors such as residential segregation, the home ownership rate for white families is 28.4 percent higher than the home ownership rate for black families

Homes are the largest investment that most American families make and by far the biggest item in their wealth portfolio. Home ownership is an even greater part of wealth composition for black families, amounting to 53 percent of wealth for blacks and 39 percent for whites. Yet, for many years, redlining, discriminatory mortgage-lending practices, lack of access to credit, and lower incomes have blocked the homeownership path for African-Americans while creating and reinforcing communities segregated by race. African-Americans, therefore, are more recent homeowners and more likely to have high-risk mortgages, hence they are more vulnerable to foreclosure and volatile housing prices."

As an aside, I want to tell you something that my landlord told me. My landlords are a black couple who bought a brownstone in Harlem in 2003 (I moved in in 2004). Since about 2002, Harlem has been in revitalization mode. The beautiful brownstones up here were decrepit and literally unsellable from the mid 80s until about 2001 or 2002. They weren’t worth the property tax payments. But in the early 2000s investors started coming in to renovate the brownstones and set them up as rental properties. But it wasn’t all investors. Some of the buyers were middle class black people who had saved enough money to buy one of these brownstones, which were worth very little at the time. My landlord told me that when he would walk across 125th street from about 2004 – 2008, people were standing out in front of every bank, trying to get people to refinance their homes. He said that he would walk by an bank and be asked, "hey, do you own your home?" He would respond in the affirmative, and then got a pitch for what sounded to him like a pretty shady refinance pitch. It turns out that they were pitching subprime refinancing. These scumbag bankers were preying on people in poor neighborhoods who were less likely to be able to spot a shady deal than someone whose parents owned a home.

I digress. Back to the study. There is a lot of interesting information in this paper, and I encourage you to click on the link that I provided to read the whole thing (it’s only 8 pages long) since I’m not going to go through all of it. I want to share another graph from the study that is really shocking;

Wow. Now let me show you why this is because I know what the racist nonracists are thinking. From the study;

"The dramatic difference in wealth accumulation from similar income gains has its roots in long-standing patterns of discrimination in hiring, training, promoting, and access to benefits that have made it much harder for African-Americans to save and build assets. Due to discriminatory factors, black workers predominate in fields that are least likely to have employer-based retirement plans and other benefits, such as administration and support and food services. As a result, wealth in black families tends to be close to what is needed to cover emergency savings while wealth in white families is well beyond the emergency threshold and can be saved or invested more readily."

So no, they’re not spending it as soon as it comes in. That’s not what’s happening here. Every piece of institutional racism cascades out into every aspect of one’s life. A friend of mine who worked in the admissions department at a big state school in California once told me something interesting. A kid graduating from Compton High with a 4.5 GPA is weighed against a kid graduating from Beverly Hills High with a 3.7 GPA. Why? Because the quality of the education is better at Beverly Hills High. And if you live in Compton, you can’t attend Beverly Hills High. The game is rigged from the very beginning.

Here’s another interesting part of the study. If a black family and a white family start off on an equal playing field with the same wealth, that $1 in income increase equals $4.03 in wealth accumulation for the black family. In other words, there’s no cascade from prior institutional racism. There is only present institutional racism that will cascade in the future.

So that was my breakdown of institutional racism and therefore institutional privilege. Part 2 of this post, which will be published tomorrow goes into societal racism, as opposed to institutional racism. And yes, I’m going to go into the cop situation because too many people seem to think that cops treat everyone equally.